Income inequality in the United States is at an all-time high, surpassing even levels seen during the Great Depression, according to a recently updated paper by University of California, Berkeley Professor Emmanuel Saez. The paper, which covers data through 2007, points to a staggering, unprecedented disparity in American incomes.

Though income inequality has been growing for some time, the paper paints a stark, disturbing portrait of wealth distribution in America. Saez calculates that in 2007 the top .01 percent of American earners took home 6 percent of total U.S. wages, a figure that has nearly doubled since 2000.

As of 2007, the top decile of American earners, Saez writes, pulled in 49.7 percent of total wages, a level that's "higher than any other year since 1917 and even surpasses 1928, the peak of stock market bubble in the 'roaring" 1920s.'"

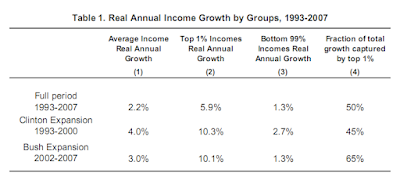

Beginning in the economic expansion of the early 1990s, Saez argues, the economy began to favor the top tiers American earners, but much of the country missed was left behind. "The top 1 percent incomes captured half of the overall economic growth over the period 1993-2007," Saes writes.

I don't know, but it sure seems like tax rates make a difference in income inequality based on the chart above.

saez-UStopincomes-2007 -

Obama's War on Inequality. How he's losing it.

Why is income inequality proving so intractable a problem? If you haven't already, you should read my colleague Tim Noah's excellent series exploring the reasons for the Great Divergence, which began sometime in the mid-'70s. It was around that time, as Malcolm Gladwell described in this New Yorker piece, that stars and professionals across a range of fields simply began to demand a bigger piece of the pie. How much you blame Obama for his lack of success in taking on this trend will depend on whether you see him as a victim of circumstances or of his own mistakes.

On one hand, Obama is up against macro forces like globalization and a system that has grown highly effective at transmuting economic privilege into political power. Somehow,wide majorities have come to support tax law changes that benefit only tiny minorities. While I was writing this column, a press release arrived in my inbox from a New York estate lawyer telling me about the goodies hidden in the new bill: "For the first time, wealthy individuals can make gifts of up to $5 million during their lifetime to anyone, including grandchildren, and pay no tax."

It's like the old Steve Martin routine about how to be a millionaire and never pay taxes—except that instead of "I forgot!" you now say, "I'm allowed!" It is an American peculiarity that rich people want to be thought of as middle class, while those in the middle class identify with the economic interests of an upper class they have only a remote chance of joining. The United States, the land of opportunity, now boasts the world's second-lowest level of intergenerational income mobility. Meanwhile, the people most alarmed about the rise of new economic dynasties seem to be the enlightened superrich themselves, people like Bill Gates and Warren Buffett.

Obama deserves fault for failing to articulate this abstract threat in a way ordinary people can appreciate. Like the deficit, income inequality never killed anybody—it merely has the potential to sap the entire country's health and spirit. Moving toward an income distribution like Brazil's threatens individual happiness, social peace, and American values. But so far, the president hasn't figured out how to get the public to relate to the issue. In April, Obama told a group of frowning bankers at Cooper Union, "There is no dividing line between Main Street and Wall Street." But there is, and it is growing deeper every year.Here is a response to the above column by Ezra Klein.

America’s Political Class Struggle

The problem is America’s corrupted politics and loss of civic morality. One political party, the Republicans, stands for little except tax cuts, which they place above any other goal. The Democrats have a bit wider set of interests, including support for health care, education, training, and infrastructure. But, like the Republicans, the Democrats, too, are keen to shower tax cuts on their major campaign contributors, predominantly rich Americans.

The result is a dangerous paradox. The US budget deficit is enormous and unsustainable. The poor are squeezed by cuts in social programs and a weak job market. One in eight Americans depends on Food Stamps to eat. Yet, despite these circumstances, one political party wants to gut tax revenues altogether, and the other is easily dragged along, against its better instincts, out of concern for keeping its rich contributors happy.

This tax-cutting frenzy comes, incredibly, after three decades of elite fiscal rule in the US that has favored the rich and powerful. Since Ronald Reagan became President in 1981, America’s budget system has been geared to supporting the accumulation of vast wealth at the top of the income distribution. Amazingly, the richest 1% of American households now has a higher net worth than the bottom 90%. The annual income of the richest 12,000 households is greater than that of the poorest 24 million households.

...

For the moment, most Americans seem to be going along with Republican arguments that it is better to close the budget deficit through spending cuts rather than tax increases. Yet when the actual budget proposals are made, there will be a growing backlash. With their backs against the wall, I predict, poor and working-class Americans will begin to agitate for social justice.

This may take time. The level of political corruption in America is staggering. Everything now is about money to run electoral campaigns, which have become incredibly expensive. The mid-term elections cost an estimated $4.5 billion, with most of the contributions coming from big corporations and rich contributors. These powerful forces, many of which operate anonymously under US law, are working relentlessly to defend those at the top of the income distribution.

But make no mistake: both parties are implicated. There is already talk that Obama will raise $1 billion or more for his re-election campaign. That sum will not come from the poor.

The problem for the rich is that, other than military spending, there is no place to cut the budget other than in areas of core support for the poor and working class. Is America really going to cut health benefits and retirement income? Will it really balance the budget by slashing education spending at a time when US students already are being out-performed by their Asian counterparts? Will America really let its public infrastructure continue to deteriorate? The rich will try to push such an agenda, but ultimately they will fail.

Obama swept to power on the promise of change. So far there has been none. His administration is filled with Wall Street bankers. His top officials leave to join the banks, as his budget director Peter Orszag recently did. He is always ready to serve the interests of the rich and powerful, with no line in the sand, no limit to “compromise.”

If this continues, a third party will emerge, committed to cleaning up American politics and restoring a measure of decency and fairness. This, too, will take time. The political system is deeply skewed against challenges to the two incumbent parties. Yet the time for change will come. The Republicans believe that they have the upper hand and can pervert the system further in favor of the rich. I believe that they will be proved wrong.

No comments:

Post a Comment